On December 15th 2016, the Government of British Columbia announced that it was taking bold action on housing and that they had created a program to help first time home buyers get into the housing market. The program offers an interest free loan of up to $37,500 for Canadians buying their first home in British Columbia.

Today is the first day applications for the downpayment assistance loan will be accepted, eligible purchases will have a completion date on or after February 15th, 2017.

When the initial announcement was made in December, there was a fair amount of uncertainty around how the assistance would actually play out. However, a lot of those details have been ironed out. Here is what you need to know!

- This is not free government money. It is a loan, and will have to be paid back.

- You must be a first time home buyer.

- You must be a Canadian citizen who has lived in BC for the last 12 months.

- The property must be located in British Columbia.

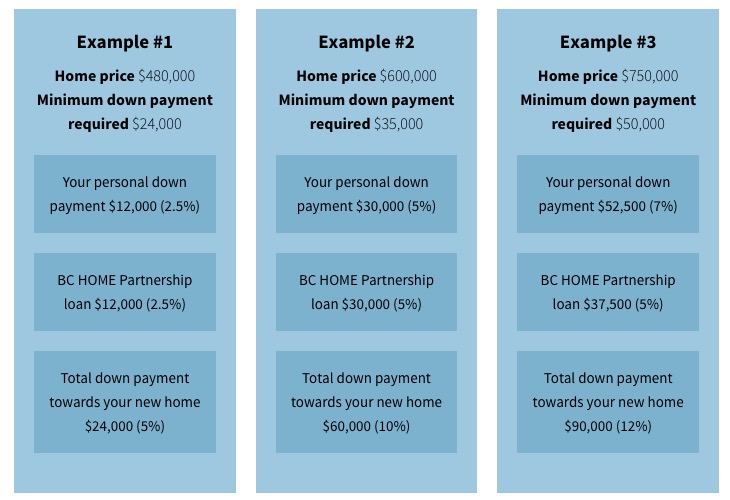

- The government will match half of the downpayment, which means you have to come up with half from your own resources (or a gift from family).

- The maximum loan amount will be $37,500.

- Maximum property purchase price is $750,000.

- Your household income cannot exceed $150,000.

- You must occupy the property as your primary residence.

- Once the home is sold, or no longer being occupied as a primary residence, the loan is due in full.

- The loan is interest free for the first 5 years, and then the balance begins to amortize over 20 years.

- Rates on the loan have not yet been disclosed.

As far as lenders and insurers are concerned, this loan is being treated like borrowed down payment, you can find the full qualifying details here. There will be an increased insurance premium in order to access this program.

Here are a few examples of how the program will work, from the BC Housing website.

The BC HOME partnership loan is for an initial 25-year term, which is interest and payment free for the first five years. The loan will be registered on your property title as a second mortgage.

If you have questions about this program, or any other mortgage questions, I would be more than happy to discuss them with you. Please contact me anytime.